Buying your first home is the start of a new chapter filled with possibilities. One of the biggest questions you’ll face on this journey is: Should you build your dream from the ground up or choose a move-in-ready home? In the Rio Grande Valley, custom home construction is booming as more buyers embrace the idea of spaces designed around their lifestyle, personality, and plans. But is building truly the key to your perfect first home, or could an existing property be the smarter path?

A custom home is designed and built specifically for you, offering complete control over layout, materials, and features. In contrast, a move-in-ready home, whether it’s a production or spec home, comes with established designs and completed finishes, and is ready for immediate occupancy. This makes them a great choice for buyers who want less waiting, fewer construction decisions, and often more predictable costs.

That leaves one big question: Should you create your perfect home from the ground up, or claim one that’s already waiting for you? This choice impacts not just your living environment but your lifestyle as a whole. Your decision will depend on several key factors:

- Budget constraints and financial priorities

- Timeline flexibility

- Desire for personalization

- Long-term housing goals

Custom Home: Tailoring Your Dream Space

A custom home is a one-of-a-kind residence built from scratch according to your specific requirements, preferences, and lifestyle needs. Unlike pre-built options, every aspect is tailored to your vision.

Key Advantages

If you’re looking for complete creative control over your home, these benefits make custom building an exciting option:

- Complete personalization of architectural style, from Craftsman to Contemporary to Mediterranean

- Freedom to choose your ideal location in the Rio Grande Valley

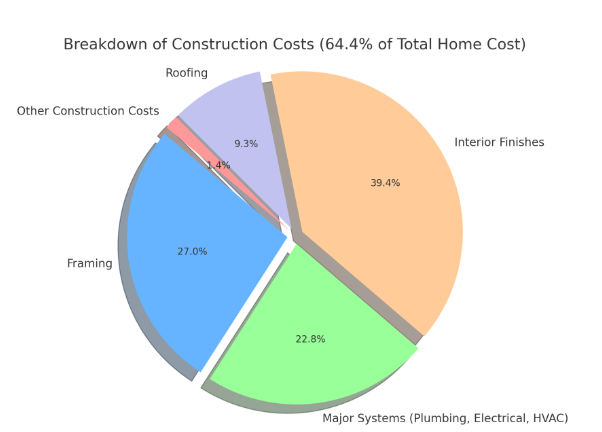

- Control over materials, finishes, and quality grade (from standard at $90-$125/sq. ft. to luxury at $175-$250+/sq. ft.)

- Ability to incorporate unique features like hobby-specific rooms, smart home technology, and energy-efficient designs

Challenges to Consider

Before committing to a custom build, it’s important to weigh the potential drawbacks that may impact your budget, timeline, and involvement:

- Longer construction timelines compared to buying pre-built homes

- Higher upfront costs and more complex financing options

- Requires significant personal involvement in decision-making throughout the process

Best Suited For

Custom homes work best for buyers who fit these profiles and priorities:

- Families with specific needs (like multi-generational living)

- Individuals with unique design preferences

- Families planning to stay in their home long-term who value the ability to create spaces that perfectly match their lifestyle.

Pre-Built Home: Convenience and Predictability

Pre-built homes are properties that are constructed before being sold to a specific buyer, including spec homes (built by developers on speculation), production homes (built in planned communities with limited floor plans), and modular homes (factory-built in sections).

Advantages

For buyers who value speed, simplicity, and cost predictability, pre-built homes offer several appealing benefits:

- Faster move-in timeframe. Often ready within weeks rather than months

- More affordable with predictable costs. Typically costs less than custom construction

- Less decision fatigue. Fewer choices to make during the purchasing process

- Established neighborhoods with existing amenities and communities

Challenges

While convenient, pre-built homes come with limitations that may not suit every buyer’s vision or priorities:

- Limited customization options. You may need to accept standard features

- Potential compromises on location or neighborhood characteristics

- Less uniqueness. Similar designs to neighboring homes

Best suited for

These homes are an excellent match for buyers who fit the following profiles and preferences:

- First-time homebuyers

- Those with tighter timelines

- Budget-conscious buyers

- Individuals who prefer simplicity over extensive personalization.

Making the Right Choice: Which Home Fits Your Lifestyle?

Choosing between a custom home and a pre-built home ultimately comes down to your specific lifestyle needs, priorities, and circumstances. Let’s summarize the key differences to help you make an informed decision.

Custom Home vs Pre-Built Home: A Comparison

The key differences between custom and pre-built homes are outlined below for easy comparison.

| Factor | Custom Home | Pre-Built Home |

|---|---|---|

| Cost Considerations | Typically requires a higher upfront investment ($120–$200 per square foot in the RGV) but offers long-term value through personalization and energy efficiency | Often has more predictable pricing and may be more affordable initially, though they might require renovations to meet specific needs |

| Timeline Expectations | Requires patience, from design through construction, the process can take 6–12 months or longer. | Offers quicker move-in timeframes, sometimes as little as 30–60 days after purchase. |

| Personalization Potential | Gives you control over everything from architectural style to smart home features and biophilic design elements | Limits customization to finishes and fixtures, with major structural changes being costly or impractical. |

| Maintenance and Efficiency | Incorporates the latest energy-efficient technologies, potentially reducing utility costs. | May require more maintenance and have lower energy efficiency, especially in older homes |

Decision-Making Checklist: Custom Home vs Prebuilt Home

Use this quick checklist to evaluate your needs, priorities, and lifestyle before deciding between a custom or pre-built home.

- Budget Assessment:

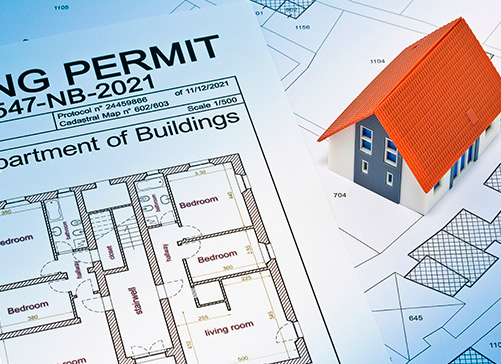

- Have you secured financing options for your preferred choice? Consider conventional loans, FHA loans, or construction loans

- Have you accounted for all costs beyond the base price (permits, landscaping, furnishings, etc.)?

- Timeline Flexibility:

- How quickly do you need to move into your new home?

- Can your current living situation accommodate an extended building process?

- Personal Involvement:

- Do you enjoy making detailed design decisions, or would you prefer a more turnkey approach?

- Are you prepared to visit construction sites and monitor progress on a regular basis?

- Long-Term Planning:

- How long do you intend to live in this home?

- Does your family have specific needs that require specialized spaces, like hobby rooms or home offices?

- Are you considering future family growth and development needs?

Remember, there’s no universally “better” option. The right choice depends entirely on your unique situation. A growing family with specific design preferences and long-term residence plans might benefit most from a custom home, while a buyer seeking simplicity, predictability, and a faster move-in might prefer a pre-built option. Take time to reflect on what truly matters to you in a home and let those priorities guide your decision.

Whether you desire the personalization of a custom home or the convenience of a pre-built option, Villa Homes Design & Build’s expert team is ready to guide you through every step of the process. Discover the benefits and find the perfect solution for your dream home today.

Explore our offerings and get started on your journey with Villa Homes Design & Build by contacting us. Learn more and take the first step towards your ideal living space!